The euphoric economy of esports – another esports bubble piece

The “euphoric economy” – what is it, and what does it have to do with the esports bubble?

As a term, the “esports bubble” has gained a lot of traction over the past few weeks. This is largely due to the brilliant investigative piece by Kotaku Senior Reporter Cecilia D’Anastasio, “Shady Numbers And Bad Business: Inside The Esports Bubble” (I strongly suggest reading this piece first), where she interviewed a range of industry experts (many anonymous) on their perceptions of the industry alongside analysis of the stats and culture surrounding viewership inflations.

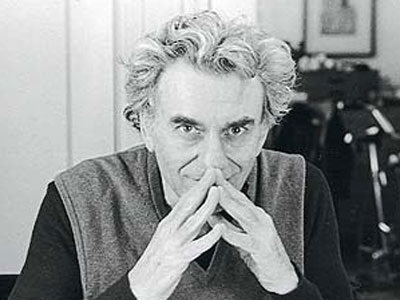

D’Anastasio’s piece cuts against the grain of the ever-positive, “meteoric rise” narrative we often hear. It really got me thinking about how bubbles have played out in other sectors and in particular the work of late-economist Hyman Minksy. While not directly translatable to esports – in this context the role of banks and interest rates is less applicable – his work on investment bubbles and particularly the “euphoric economy” can serve as food for thought on where the industry is at, and where it could go.

Minsky first coined the term in 1982, and it may not be as grand as the name suggests.

His life’s work was dedicated to what he called the “financial instability hypothesis” – his assertion that speculative investment bubbles are intrinsic to financial markets. He argues that we must accept that it is a natural part of the market cycle, and leaves these markets fundamentally fragile due with a propensity for boom and bust.

Although he developed his hypothesis from the 80s through to his passing in 1996, his work failed to gain traction until the Global Financial Crisis of 2007-08. In the fallout of the subprime mortgage crisis and subsequent GFC, more mainstream economists began to consider the value of Minsky’s work. In particular, the description of economic bubbles and how to track their development to a critical moment, a euphoric economic moment.

To grasp what that looks like, you first have to understand how you get there.

There are of course some important caveats in thinking about esports with Minsky in mind: the role of banks and interest rates as mentioned, and the presence of what he terms the ‘Ponzi financier’, which would need some more consideration than this article allows.

In its initial development, an industry is growing slowly, but investors are conservative in their commitments. This is in part due to universally practised risk aversion, but also memories of past failures (e.g. Championship Gaming Series), as such, risk premiums are very high. However, a combination of continued growth and conservative, but targeted investment, increasingly ambitious projects begin to succeed. Gradually, two things become clear to endemic and non-endemic investors:

1. These projects are delivering an increasingly worthwhile return on investment (ROI).

2. I need to get in on this, strike while the iron is hot!

Actors and organisation in the industry begin to be evaluated differently; the risk premium changes and investment projects are evaluated using less conservative estimates of prospective cash flow. With these rising expectations come rising levels of investment, and subsequent valuations and asset price estimates. As the size and scale of these organisations and their projects grow, ballooned by rising investment despite lacklustre cash flow, more and more external finance is needed to keep the ball rolling.

External investors begin to share the industry’s optimism and join the party as more liquid assets are pumped into organisations. Organisation liquidity decreases as they make more commitments to teams, leagues, and more. All the while, investor expected ROI accelerates.

SEE ALSO: Five predictions for the esports industry in 2019

This is the beginning of what Minsky described as a euphoric economy. Both investors and organisations believe that future success is assured, and therefore that their investments will succeed (or they are committed to the point that they have to succeed). As such, valuations and asset prices are continually pushed upwards, as previous valuations are perceived to be based on mistakenly conservative grounds.

as it stands right now, i do not believe esports is in a bubble nor is one coming soon

however as we can see there are several very real concerns for esports that industry leaders and the community must address for a healthy, trustworthy ecosystempic.twitter.com/wA3VsKf9eB

— Rod Breslau (@Slasher) May 28, 2019

With expectations high for the industry, you see a boom in the sector and with it some major success stories. You also see the proliferation of organisations and investors entering the scene with increasingly varying and potentially risky structures, models, and ideas of sustainability. Non-endemics see the ‘euphoria’ and opportunities the industry projects (based on these inflated valuations) and join the party with even more liquid assets, keen to take their slice of the pie – the bubble forms.

While non-endemic participation is not intrinsically a negative thing, its positives are counterbalanced by the fact that the core challenge has not been addressed. The bubble continues to grow, and the industry kicks the proverbial can further down the road.

If this is the case for esports, what happens next?

It depends on who you ask. A big part of it is whether you’re an optimist or a pessimist. Forging a cash-flow positive business model is the key challenge for organisations at this moment in an industry that breeds innovation. The telltale sign will be whether the largest and most highly valued organisations will be able to deliver on their ROI expectations and before investor confidence, and the big money that comes with it dries up.

I would like to credit Steve Keen’s 2011 piece, “A monetary Minsky model of the Great Moderation and the Great Recession”, which served as the basis for this article.